On January 6, 2017, JANA Partners, a New York–based activist hedge fund, and the California State Teachers’ Retirement System (CalSTRS) sent a letter to Apple’s board of directors that may change the future of activist investing. Citing a substantial body of expert research, the letter stated, “We believe there is a clear need for Apple to offer parents more choices and tools to help them ensure that young consumers are using your products in an optimal manner.” Overuse of iPhones by children and teenagers, the letter pointed out, has been linked to lack of attention in the classroom, difficulty in empathizing with others, depression, sleep deprivation, and a higher risk of suicide.

Jana and CalSTRS together own $2 billion in Apple stock, so it’s no surprise that the letter received worldwide attention after it was publicized by the Wall Street Journal. What was surprising, however, was the unlikely partnership between JANA and CalSTRS. The term “activist hedge fund” connotes to many a “corporate raider” who creates short-term profits at the expense of other stakeholders and long-term investors. But CalSTRS is one of the world’s leading asset owners on the importance of integrating environmental, social, and governance (ESG) issues into investment decisions — investing as a way of maximizing returns while making the world a better place — so why would it be interested in partnering with an activist hedge fund?

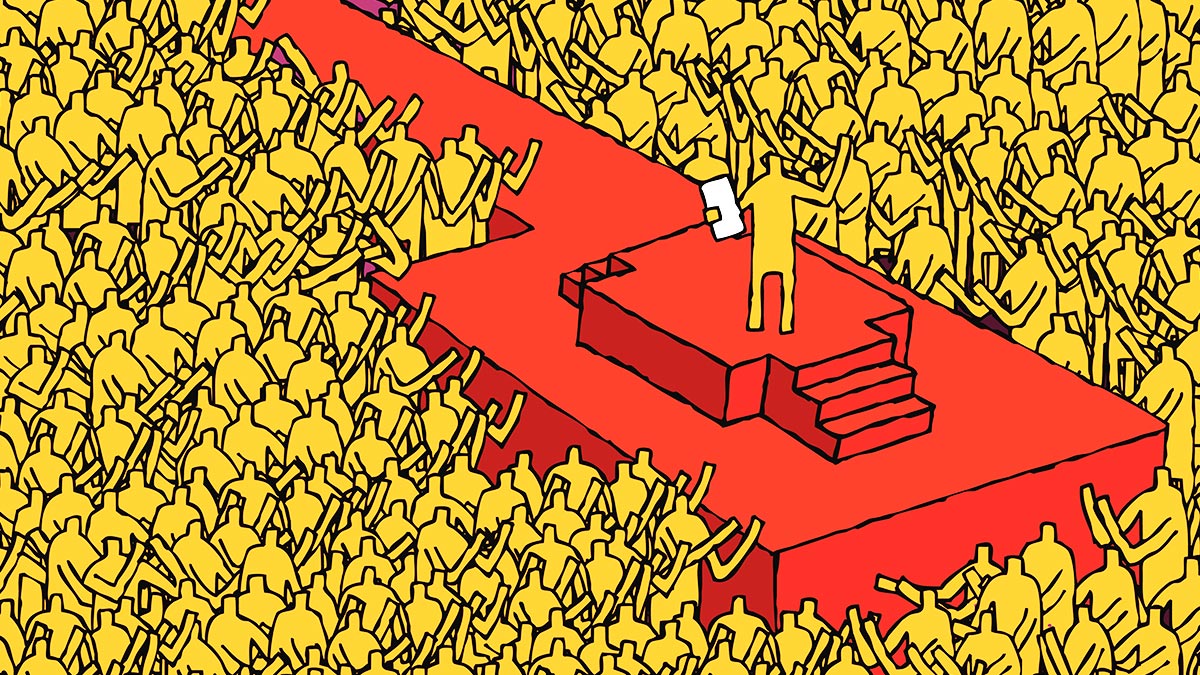

The truth is that the worlds of activism and impact investing are converging much more swiftly than most people realize — and this union holds enormous promise for those who wish to see the creation of capital markets that support sustainable economic development. JANA is perhaps most public among activist investors about this shift, having recently announced that it is raising an impact fund to extend its Apple campaign to other companies with the help of an influential advisory board that includes Sister Patricia A. Daly, OP; Sting; Trudie Styler; and myself. But it is reportedly not alone.

How is it that sharp-toothed activists are becoming advocates of long-term sustainable investing? A main explanation is that, as always, they are following the money. The market size for responsible investment is large and growing, with some of the largest asset managers like BlackRock, State Street Global Advisors, and Vanguard responding to demand by opening ESG-themed funds in recent years. According to US SIF, at the end of 2018 there was $8.72 trillion in sustainable and impact investing strategies, representing one out of every five dollars being professionally managed. BlackRock has gone even further. In a letter this week, CEO Larry Fink has announced that corporations “need to contribute to society” as well as be profitable if they want to retain BlackRock’s support as a shareholder — often one of their largest ones.

But it’s also true that many activists are not as short-term as many assume them to be. Despite their reputation as slash-and-burn financial engineers, activists are actually no strangers to seeking returns from genuine, long-term value creation. Empirical research, such as the article “The Long-Term Effects of Hedge Fund Activism,” by Lucian A. Bebchuk, Alon Brav, and Wei Jiang, shows that in contrast to prevailing beliefs, the long-term effects of activist hedge funds are positive rather than negative. In a study of 2,000 activist hedge fund interventions over the period 1994 to 2007, where performance was tracked for five years after the intervention, they concluded: “We find no evidence that interventions, including the investment-limiting and adversarial interventions that are especially resisted by opponents, are followed in the long term by declines in operating performance. Indeed, we find evidence that such interventions are followed by long-term improvements, rather than declines, in performance.”

Thus, the issue isn’t one of time frames per se. Rather, it’s the dawning recognition of the activist hedge fund community that material environmental and social factors are value-relevant in the time frames in which they are already operating. This is true from both a downside risk and upside opportunity perspective — both of which exist at Apple. JANA and CalSTRS have recommended to Apple that it form an expert committee to oversee research on this issue, help develop new tools and options to control overuse of the iPhone, educate consumers, and report on its progress. JANA is doing this because it thinks the business decision is right for Apple and will create value for its shareholders in the long term. It’s as simple as that.

It’s difficult to describe how excited I feel about the prospect of an activist hedge fund pushing an ESG agenda in such a public way. It’s like Nixon going to China. If the hard-nosed activist hedge fund community thinks ESG is important, what more is there to say to convert skeptical managers, investors, and policy makers? This is a game changer.

Big asset owners, like CalSTRS, have been doing engagement for years because they recognize that in order to earn the long-term returns they need for their beneficiaries, their portfolio companies have to take their material ESG issues into account. What firms like JANA bring to the table is a very sophisticated process for identifying undervalued companies and increasing their value by improving their performance — now across a broader range of dimensions. They also know how to mobilize the broader investment community to support the changes they want to see.

SUBSCRIBE TO OUR NEWSLETTER

Subscribe our newsletter to receive the latest news, articles and exclusive podcasts every week