“Climate risk is financial risk” is an increasingly ubiquitous incantation. It is frequently invoked in discussions about shareholder proposals, the need for companies to adopt transition plans (which I have discussed before), asset managers’ engagement with portfolio companies, and banks’ financing of fossil fuels, to name a few topics.

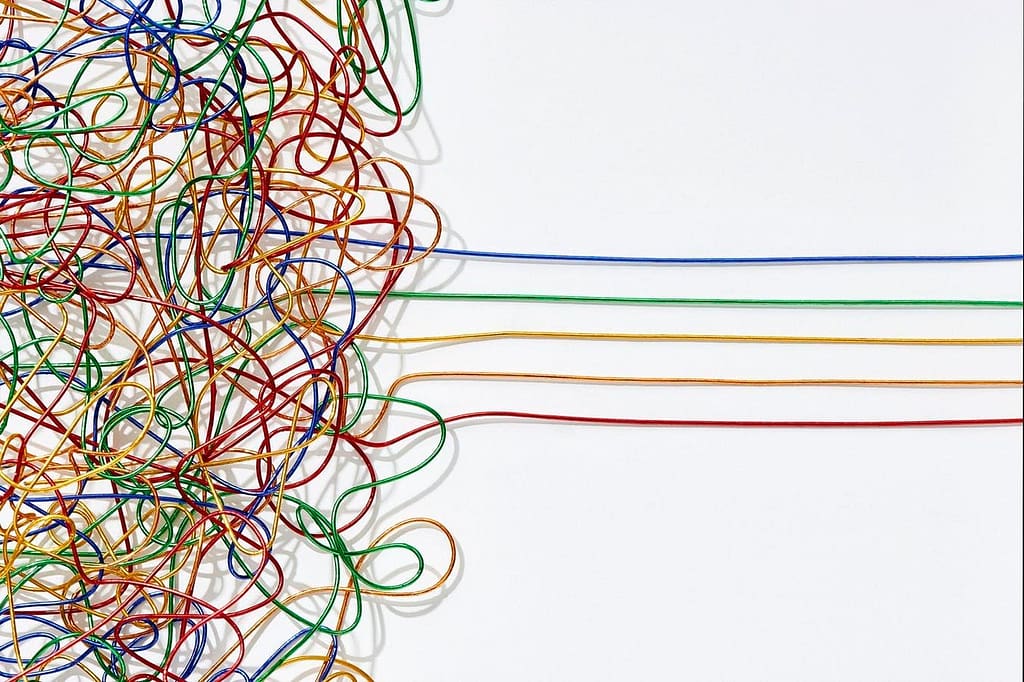

Jumble of multicoloured wires untangling into straight lines over a white background. Cape Town, South Africa. Feb 2019 | GETTY

The problem is that this incantation is often used to conflate climate impact with financial risk, with the assumption that emissions equate to financial risk and that managing climate-related financial risk will deliver net-zero outcomes. While climate risk certainly can pose financial risk, climate risk is not always financial risk, and managing the financial risk from climate change is not the same thing as managing climate impact. Impact can be high even when financial risk is low.

Moreover, characterizing what are really calls for emissions reduction as calls to address financial risk has now politicized the discussion about what needs to be done to create a net-zero world and may now doing more harm than good. Unless we are able to untangle the conflation of climate risk, financial risk, and climate impact we will see continued politicization of climate risk founded in a misplaced reliance on the financial sector to drive the energy transition.

Consider the reaction to BlackRock, J.P. Morgan Asset Management, and State Street Global Advisors withdrawing from Climate Action 100+. Cries of outrage claiming that this was a setback for the climate agenda were met by cheers that these investors were backing off of a progressive “woke” agenda. In fact, neither is true. Asset managers are fiduciaries. Their engagement with portfolio companies has always been about risk-adjusted returns, in line with the stated aims of the investment strategies they manage. But the source of the controversy clearly has nothing to do with financial risk. The controversy is because both camps have conflated asset managers’ engagement on risk-adjusted returns with engagement on climate impact, and mistakenly assume that asset managers have the ability to drive the economy to decarbonize faster. The criticism from both sides reflects just how far the narrative has slipped away from reality.

SUBSCRIBE TO OUR NEWSLETTER

Subscribe our newsletter to receive the latest news, articles and exclusive podcasts every week