One of its attributes that Makes America Great Again and Again is that people are free to express a wide range of views. For example, on the left there are people grounded in reality who believe that Joe Biden was lawfully elected as President of the United States of America, that he still will be next month, that there was an insurrection in the nation’s capital on January 6, and that COVID-19 vaccines prevent illness and save lives. On the right there are those living in Republican Trump Fantasyland (the RTF is the new GOP) who believe the election was stolen, that Donald Trump will miraculously become President next month, that a friendly group of tourists visited the capital on January 6, and that the vaccine carries a tracking microchip or even turns people into “potted plants.”

Subject: A potted herb garden by the kitchen window. | GETTY

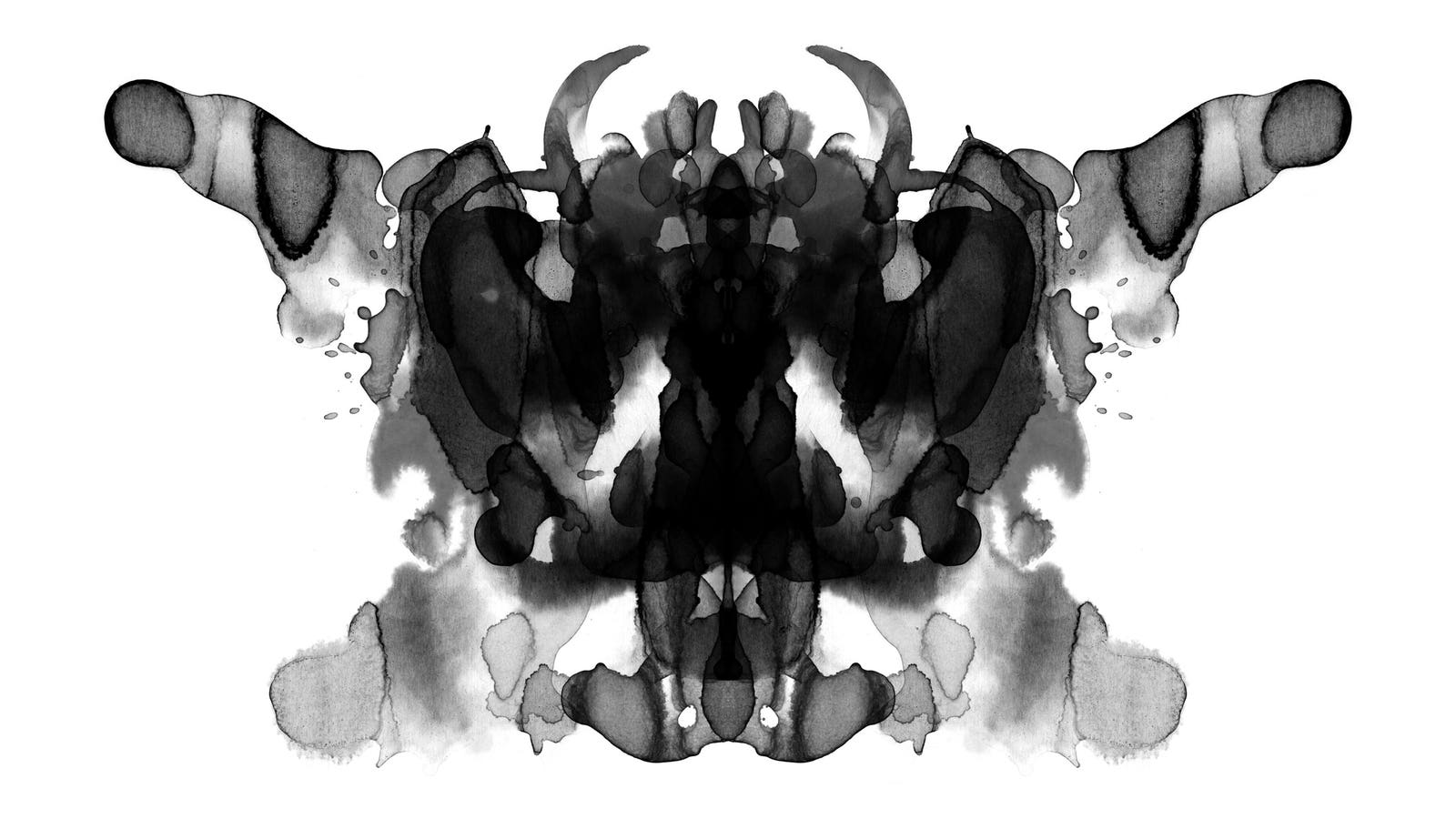

There is a similarly wide range of political views about a more prosaic topic: the role and governance of the International Sustainability Standards Board (ISSB) that will be established by the IFRS Foundation (the Foundation). In addition to raising interesting and important questions about somewhat arcane issues like materiality and metrics, the ISSB is turning out to be a Rorschach test across the ideological spectrum. At one extreme is SEC Commissioner and RTF member SEC Commissioner Hester Peirce (R). (In her heart she knows she’s right.) At the other extreme is accounting Professor Carol Adams who takes umbrage at the very name of the ISSB. I will elaborate on both of their views, but first a bit of background for the reader who is not familiar with the organizational and political issues facing the ISSB.

The first step in establishing the ISSB was a Consultation Paper which received an overwhelmingly enthusiastic response, including from the investment community. My Oxford colleague Professor Richard Barker and I provided a comment letter strongly supporting the ISSB. The basic idea behind the ISSB is to set standards for reporting on a company’s performance on material sustainability issues . Seems pretty obvious and sensible to me. Imagine a world in which there were no standards for financial accounting and reporting—which was the case in the U.S. before the formation of the Securities and Exchange Commission in 1934. At that time companies had great flexibility to determine things like revenue recognition and didn’t have to report it if they didn’t want to, even if they were listed. The Wild West, right? The same is now the case for sustainability reporting. Because of the strong relationship between financial performance and sustainability performance, investors need relevant, reliable, and comparable information for both. I have written about the importance of having a global baseline of sustainability reporting standards. We now have an exciting opportunity to make this happen.

SUBSCRIBE TO OUR NEWSLETTER

Subscribe our newsletter to receive the latest news, articles and exclusive podcasts every week