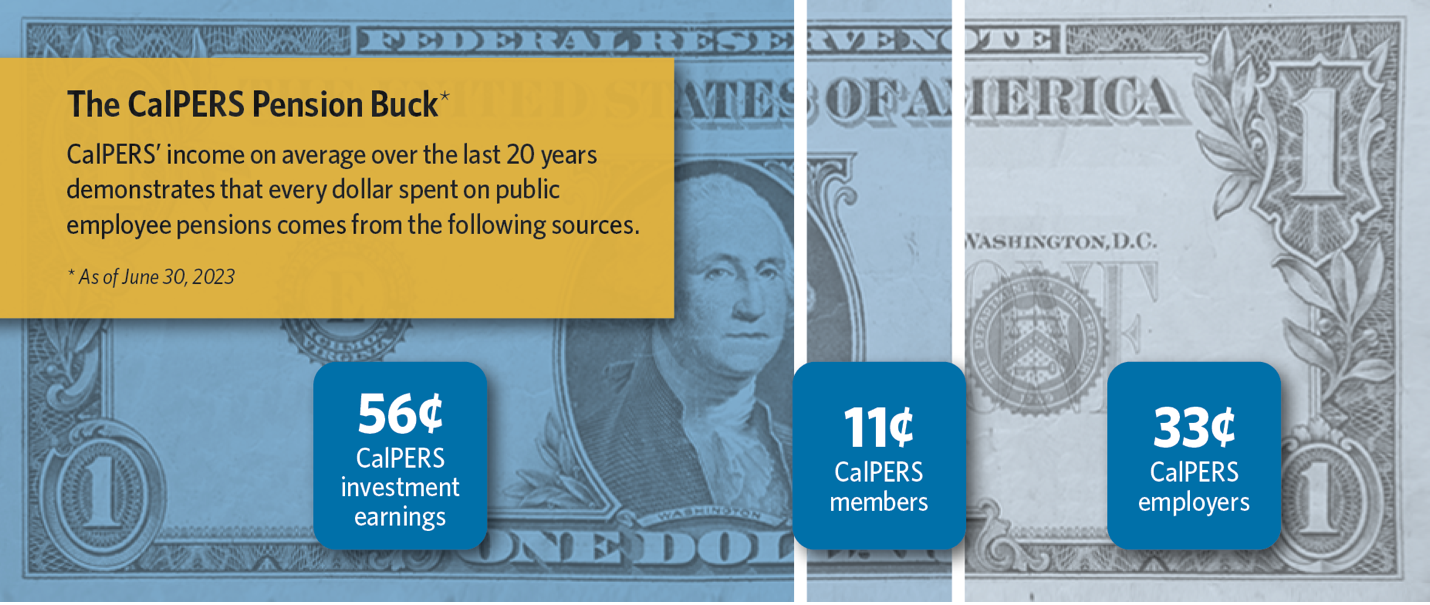

The California Public Employees’ Retirement System (CalPERS) has 2.2 million members and assets of around $510 billion. It is the largest state pension fund in the U.S. On its website it notes that “Under the California Constitution, the Board of Administration has a fiduciary duty to act in the best interests of its members and employers.” Which means generating long-term returns since it has current liabilities for generations to come. As shown in “The CalPERS Pension Buck,” of the $31 billion in payouts to beneficiaries in 2022-23, 56% came out of investment earnings.

The CalPERS Pension Buck | CALPERS

CalPERS is known for being a leader in sustainable investing. This has subjected it to critics on both the left (e.g., CalPERS isn’t doing enough to save the world from climate change and to promote DEI) and the right (e.g., CalPERS is pursuing a progressive liberal agenda on topics like climate change and DEI). What both critics fail to recognize is that the pension fund’s commitment to sustainable investing is based on its constitutionally enshrined fiduciary duty.

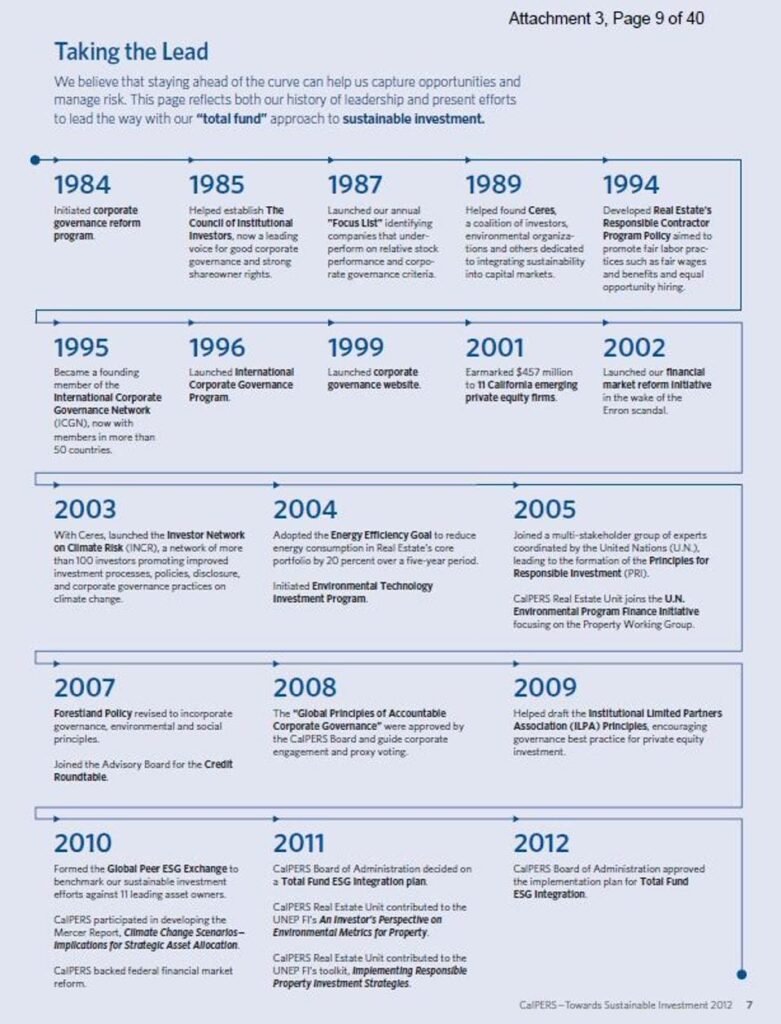

In 2012 CalPERS published its first report on sustainable investing, “Towards Sustainable Investment: TAKING RESPONSIBILITY.” This report traces the origins of sustainable investing back to 1984 when it started its corporate governance reform program, 20 years before the UN Global Compact issued its 2004 report titled “Who Cares Wins: Connecting Financial Markets to a Changing World” which coined the now highly politicized acronym ESG (environmental, social, and governance). Page 7 of the report contains a chart (below) which identifies some of the major milestones in the development of sustainable investing at CalPERS as of 2012.

Looking at this chart, two phrases come to mind which explain the evolution of sustainable investing at CalPERS. The first is “field building” and the second is “building internal capabilities.” The former refers to actions in which CalPERS has taken a lead in providing the necessary infrastructure and platforms for sustainable investing. Examples of this include helping to establish the Council of Institutional Investors (CII-1985), helping to found Ceres (1989), being a founding member of the International Corporate Governance Network (ICGN-1995), launching with Ceres the Investor Network on Climate Risk (INCR-2003), helping to found the Principles for Responsible Investment (PRI-2005), helping to draft the Institutional Limited Partners Association (ILPA-2009) Principles for PE investing, and forming the Global Peer ESG Exchange (2010).

SUBSCRIBE TO OUR NEWSLETTER

Subscribe our newsletter to receive the latest news, articles and exclusive podcasts every week