Companies and investors are being asked to support the 17 Sustainable Development Goals (SDGs) for 2030 — what some have described as “the closest thing the Earth has to a strategy”— since the public sector alone does not have the resources to do so. With Professor Costanza Consolandi of the University of Siena I have written about how companies can use the work of the Sustainability Accounting Standards Board (SASB) to assess the impact they are having on the SDGs.

But what about investors? For them the problem is a more difficult one since they hold large portfolios of companies and must aggregate information about all of them. An additional complexity is that the very large asset owners and asset managers must pay increasing attention to the system-level effects of their investments. Are their investments making a positive or negative contribution to the financial, environmental, and social systems that support human life on Earth? Sudden shocks (e.g., the Financial Crisis of 2008) and steady and persistent degradations (e.g., from climate change to inequality) in these systems will make it impossible for investors to earn the returns expected by their ultimate beneficiaries—all of us.

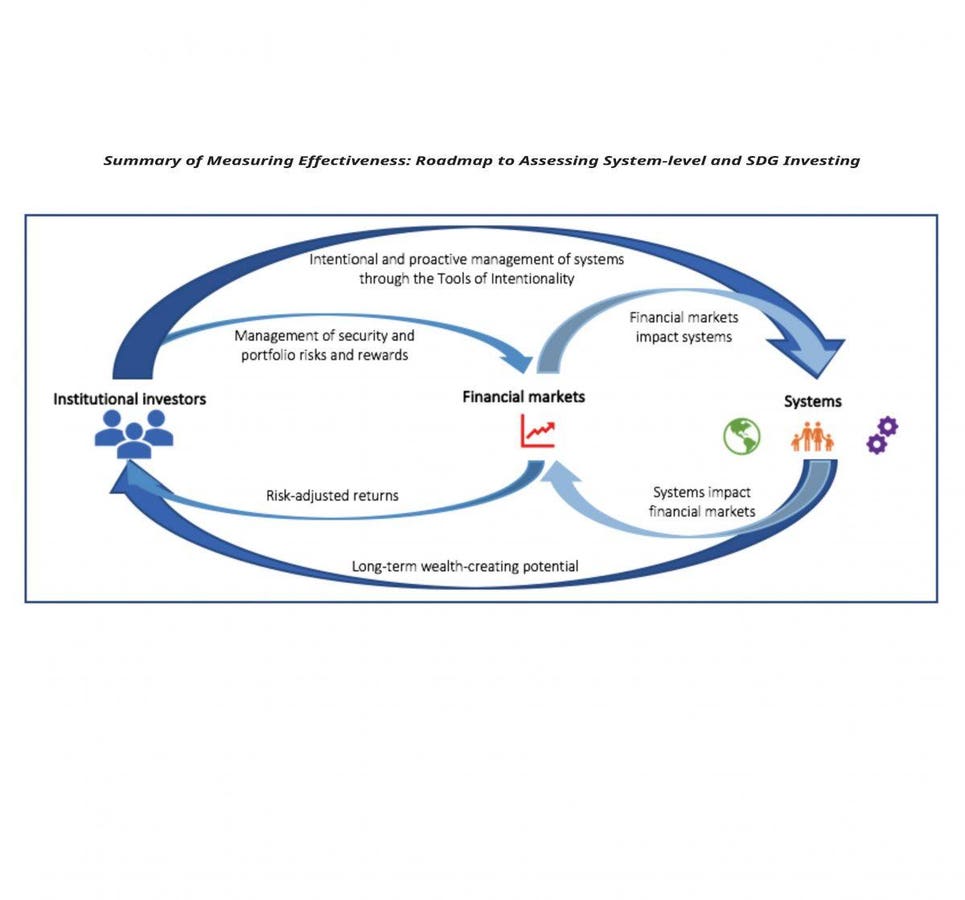

The Investment Integration Project (TIIP), under the leadership of Steve Lydenberg (Founder and CEO) and William Burckart (President and COO) is a research services firm that provides guidance to investors on system-level issues. Its mission is “to help institutional investors understand the feedback loops between their investments and the planet’s overarching systems that make profitable investment opportunities possible.” Just as modern portfolio theory extended analysis of individual stocks to a basket of stocks, TIIP helps investors to move their level of analysis beyond just portfolios to include the context in which these portfolios exist. This is important because failure to do so will lead to dramatic disruptions (e.g., the Financial Crisis of 2008) and steady or even dramatic degradations (e.g., from climate change and inequality) that will make it impossible for investors to earn the returns necessary to meet the expectations of their beneficiaries and clients, respectively.

Today, in collaboration with the Investor Responsibility Research Center Institute (IRRCi), Burckart, Lydenberg, and Jessica Ziegler have published a new report Measuring Effectiveness: Roadmap to Assessing System-level and SDG Investing. A companion document to the report, Measuring Effectiveness: Roadmap to Assessing System-level and SDG Investing—Supplemental Appendices, contains a series of appendices that support and provide additional context for and information about the concepts discussed. This report was first discussed at a conference, available on this video, that was held at Morningstar on February 8, 2018. As explained by Burckart, ““TIIP has spent the past three years growing a shelf of research and guidance, and a database that covers the basics of systems-level investing. With this new report we are tackling the challenging questions of how investors can measure their influence at a system level, and how investors can tell who is doing a good job and who is doing a better job. Over the course of 2018 we will be applying this framework to different issues, such as income inequality, as well as releasing comprehensive guidance for reporting on system-level investing progress.”

SUBSCRIBE TO OUR NEWSLETTER

Subscribe our newsletter to receive the latest news, articles and exclusive podcasts every week